georgia ad valorem tax motorcycle

MV-9W Please refer to this form for detailed instructions and requirements. Sign in to TurboTax Online then click Deductions Credits Review or Edit.

We Are Prominent Tax Firm Operating In Both Atlanta And Georgia We Have Highly Skilled And Profess Bookkeeping Services Small Business Consulting Tax Services

Motorcycles may be subject to the following fees for registration and renewals.

. Ad Valorem Tax Required. Registration Fees Taxes. Submit the above either in person or by mail to your local county tag office.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of.

Title Ad Valorem Tax TAVT The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. 2000 annual registration fee. Georgia requires minimum-liability insurance on all motor vehicles.

18 title fee and 10 fees for late registration. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. 393 Type of Motorcycle Currently Riding.

Select Value 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 0 Place mouse over to. Only one additional plate issued. Your Georgia drivers license or ID.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. This includes an annual registration and tag fee of twenty dollars an ad Valorem tax sales tax and a title fee of eighteen dollars. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle.

Jan 14 2015 1. Get the estimated TAVT tax based on the value of the vehicle using. TAVT is a one-time tax that is paid at the time the vehicle is titled.

Cost of additional plate. 2500 one time fee Annual Registration Fee. Valid drivers license or picture ID.

Annual Special Tag Fee. 20 annual registrationtag fee. You will need to pay the following fees when applying for motorcycle registration and title.

Title Ad Valorem Tax TAVT became effective on March 1 2013. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. The tax must be paid at the time of sale by Georgia residents or within six months of.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. 2012 Black Cross Country. Georgia ad valorem tax motorcycle Wednesday March 9 2022 Edit.

This tax is based on the value of the vehicle. To enter your Personal Property Taxes take the following steps. Anybody registered a 2012 or 2013 victory in Georgia brought in from another.

According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes. Title Ad Valorem Tax TAVT - FAQ. Payment for the 20 registration fee plus any other applicable taxes and fees.

If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time. Ad Valorem Taxes If applicable no exemptions on additional tags. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Proof of Georgia motorcycle insurance. US Army Ranger Motorcycle. Jul 26 2012 Messages.

New Plate Demo Page. Ad valorem tax which varies depending on your motorcycles purchase price. What is annual ad valorem tax.

Ad Valorem Taxes If applicable Cost to renew additional plate. Only one tag issued. Yes if applicable.

The assessed value of the property is used to compute a tax annually levied on the property owner by a municipality or other government entity. 2500 manufacturing fee one-time fee 2000 annual registration fee. We would like to show you a description here but the site wont allow us.

Under Georgia tax law a purchaser of a motor vehicle must pay a title ad valorem tax TAVT of 7.

Georgia Title Ad Valorem Tax Updated Youtube

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Tax Map Tax Foundation

Georgia Motor Vehicle Ad Valorem Assessment Manual

2021 Property Tax Bills Sent Out Cobb County Georgia

Tax Rates Gordon County Government

James Hardwick Discovered In Oregon Motor Vehicle Registrations 1911 1946 Motor Car Vehicles Motor

Form Pt 471 Fillable Service Member S Affidavit For Exemption Of Ad Valorem Taxes For Motor Vehicles

Vehicle Taxes Dekalb Tax Commissioner

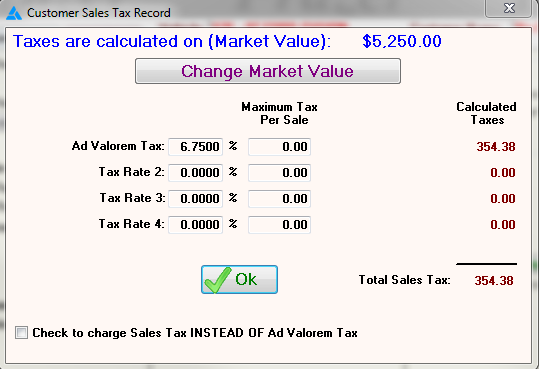

Frazer Software For The Used Car Dealer State Specific Information Georgia

Georgia Used Car Sales Tax Fees

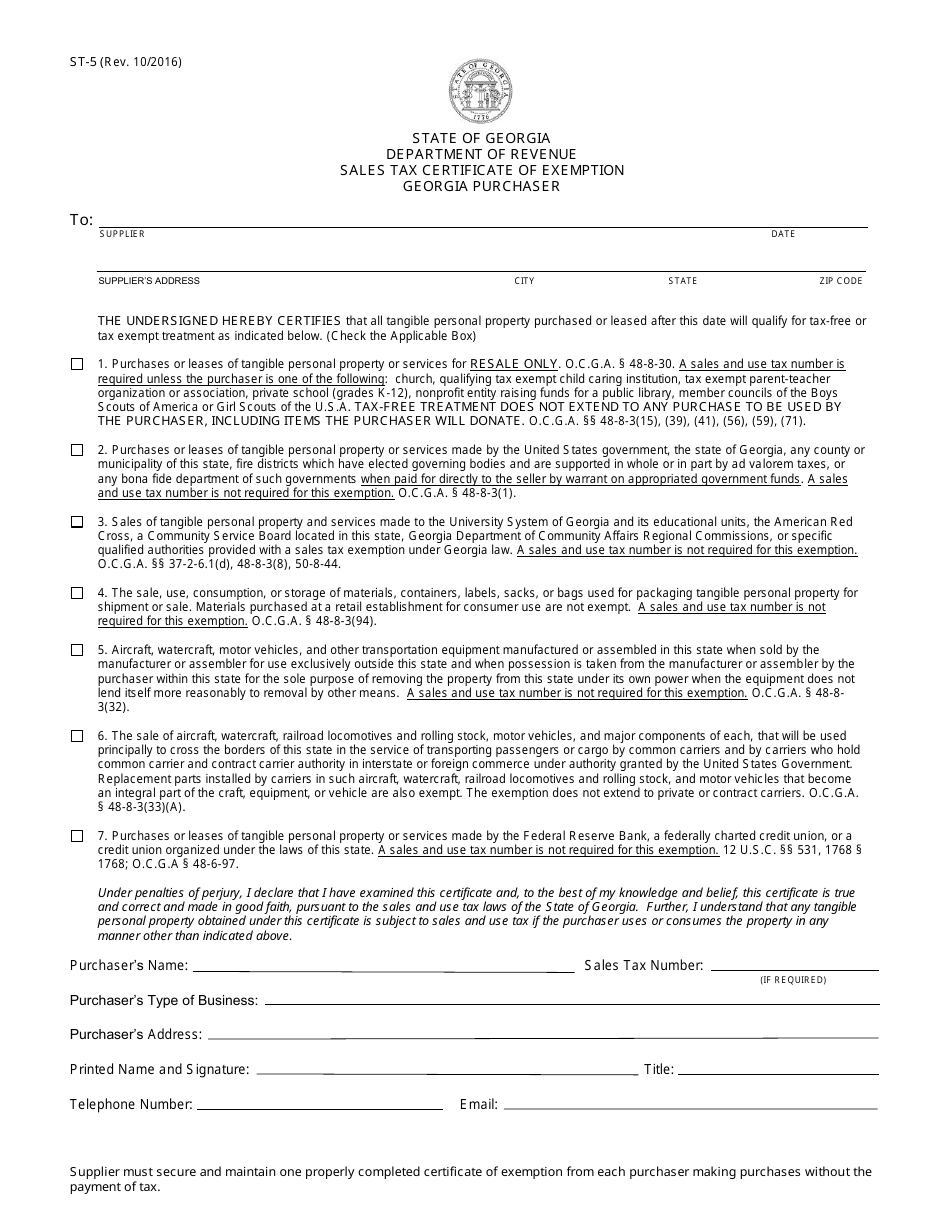

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller