reit dividend tax canada

Today we have identified four Canadian REITs that have strong dividend yields as well as YTD. First the Canadian government actually claims some tax on dividends paid to United States residents and residents of all other non-Canadian countries.

Pin On Dividend Investing Ideas

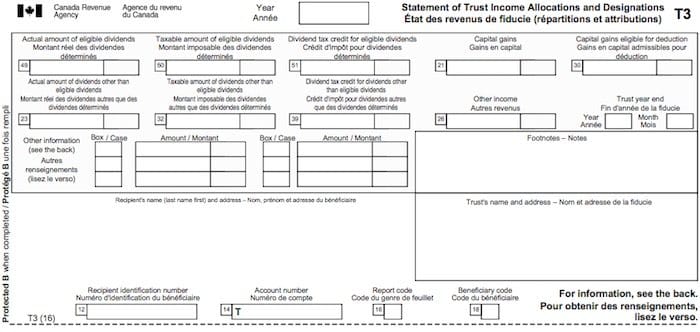

More about REITs Canada Canada offers special tax treatment for Canadian income trusts.

. 15 Withheld No Foreign Tax. The tax component of qualified dividends is taxed at 150198 percent while the tax portion of non. At least 75 of the total fair market value of all trust properties that the REIT holds must be in Canada.

Depending on the where the country of the corporation is based there might be a foreign tax credit claimable though. Dividends fromREITs are commonly taxed as ordinary income under a maximum of 37 returning to 3965With 3 additional increases in 2026 the rate will be 6Investments are subject to an 8 surtaxIn addition most individuals can generally deduct 20 of the combined Qualified Business Income earned up to December 31 from their respective qualified business. Income tax rate applies.

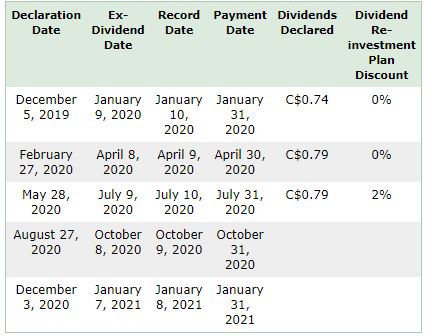

So you would claim 506 as dividend income on your return. 2 Buyable REITs With Swelling Yields. To be considered a REIT the Company must return a minimum of 90 of its taxable income each year to its shareholders in the form of dividends.

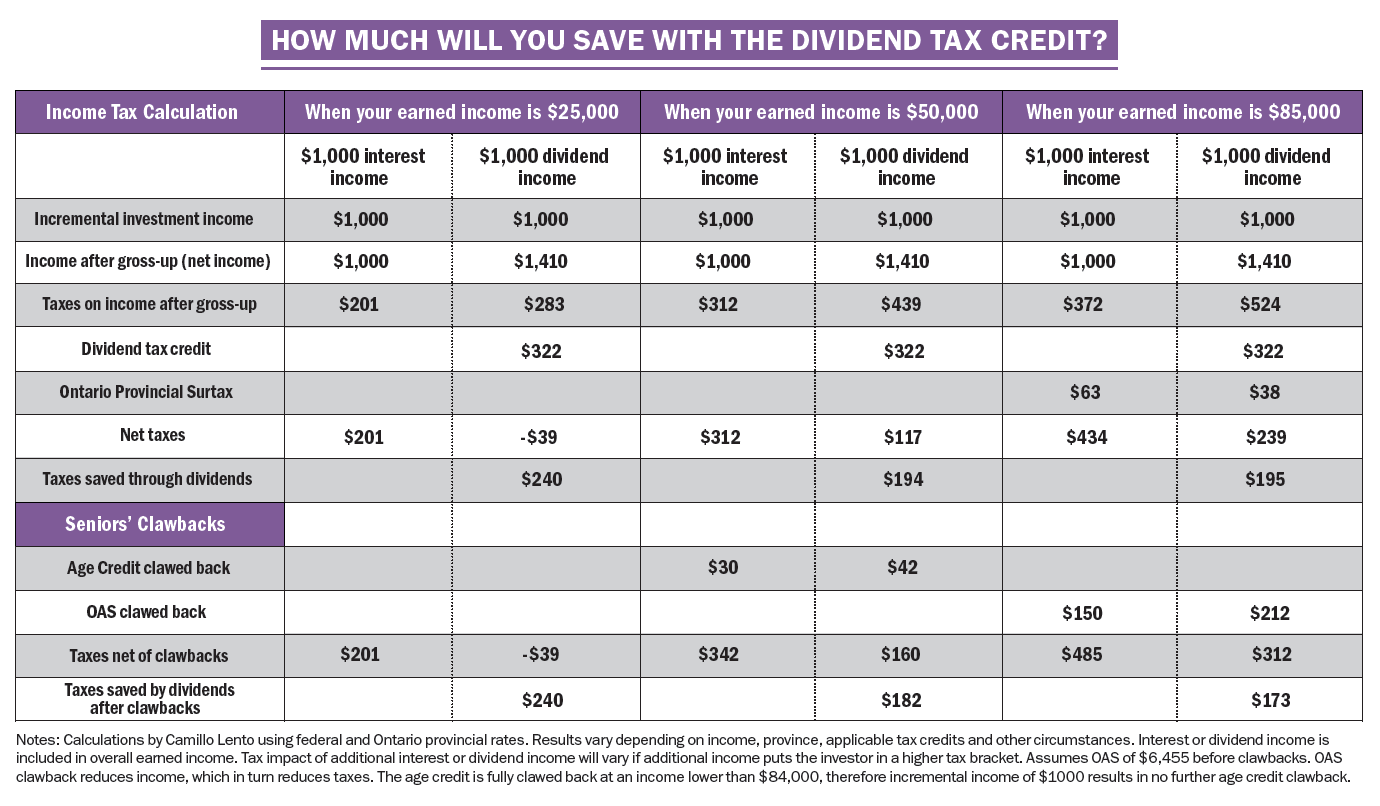

This is performed by a gross-up of eligible and non-eligible dividends. On a 1000 dividend where the ratio for. CRA basically subsidizes dividend investors for the tax the corporation already paid on dividends.

When a shareholder receives a dividend they must include it in their tax return. Citizens may claim a foreign tax credit up to 300 for single tax payers and 800 for married couples filing jointly. Dividends are federal and provincial taxes.

Canadian Distributions REITs Income Trusts Normal income and Capital Gains taxes can apply. An in-depth example of the dividend tax credit in action Its very likely all of this is still confusing to you. Taxable amount of the eligible dividends 200 X 138 276.

The tax rate applied to dividend income is not what the individual taxpayer pays. Dividend Tax Implications for Canadian Stocks The Dividend Tax Treaty. The federal government adds a 38 to eligible dividends and 15 to non-eligible dividends to get a gross-up total.

This means dividends from REITs are typically considered as ineligible dividends and thus are not eligible for the Dividend Tax Credit. The REIT collects rental income pays its expenses and then distributes almost all. Investors pay tax on most of the distributions as ordinary.

15 on the first 50197 of taxable income 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625. 15 Withheld Foreign Tax Credit can be claimed. Melcor REIT TSXMRUN is one such company.

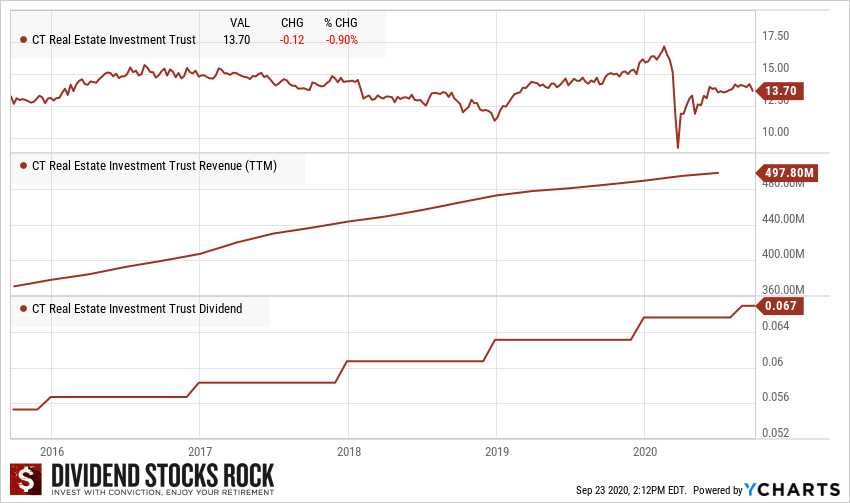

Dividend taxes are where owning Canadian securities becomes more complicated from a tax perspective. When calculated by taking into account the 20 deduction a Qualified REIT Dividend usually pays the highest tax rate of 290. It offers a compound annual growth rate of 067 over the last five years but make sure to look at that.

In mid-March this Canadian REIT reduced the monthly distribution to 003. Are dividends included in taxable income in Canada. Lets say I earned 1000 in eligible dividends.

812 of 1380 11206 This tax credit can then be applied to your overall dividend income and after the tax credits are applied the remaining income will be taxed at your nominal tax rate. When they flow their income through to their unitholders the REITs dont pay much if any corporate tax. In 2026 the budget will rise to 6 with an additional 3.

The CRA gross-up is 38. The tax withholding applies to REITs held in tax-sheltered as well as regular accounts. A simplified example for eligible dividends.

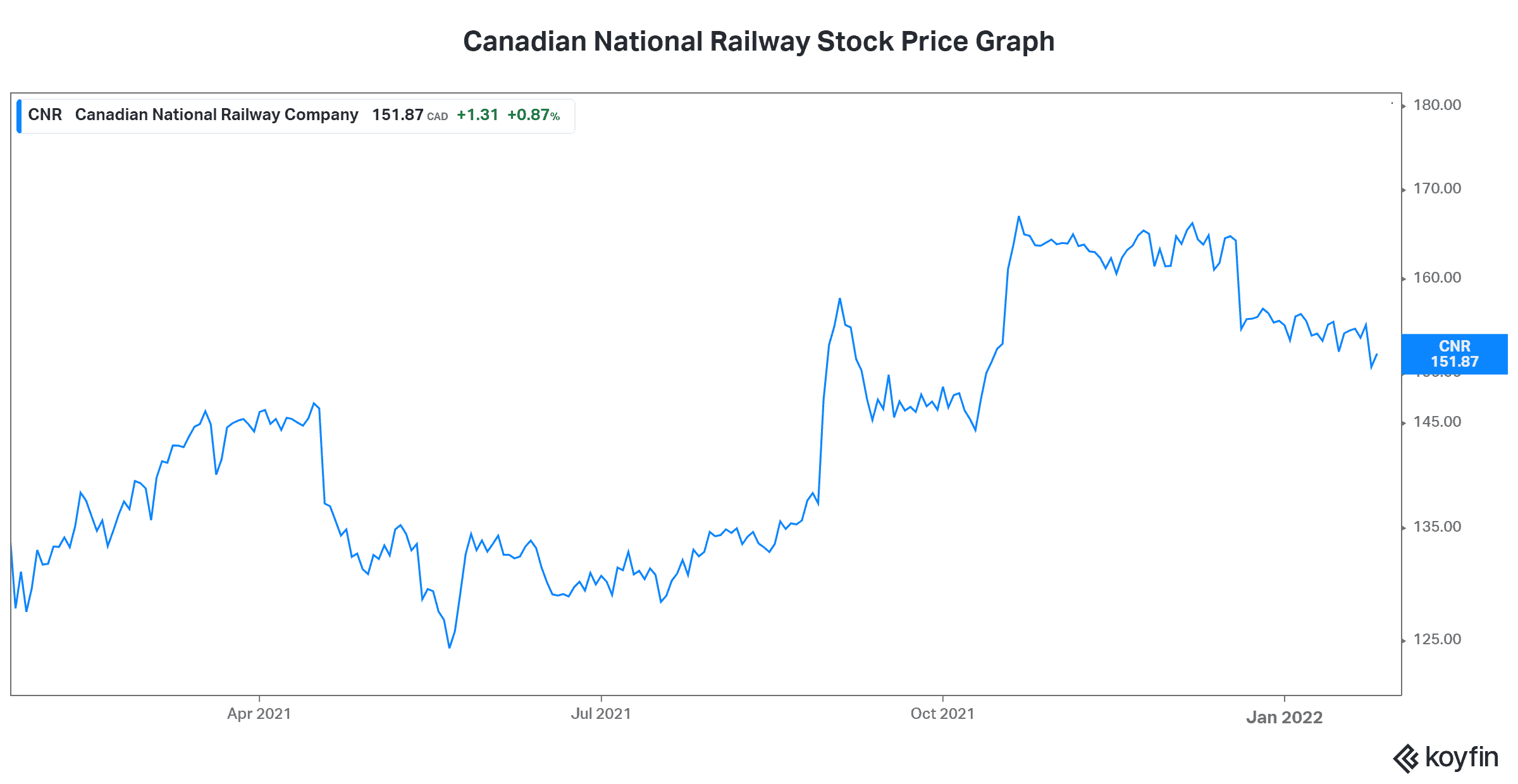

HR REIT TSXHRUN and another sold-off REIT are great buys for Canadian investors looking to navigate through a challenging environment. Melcor acquires manages and leases commercial property in Western Canada. REITs real estate.

Then Taxable amount of the other than eligible dividends 200 X 115 230 Total taxable amount 276 230 506 You will report the total taxable dividends on line 12000 of your income tax return. 35 rows Now you might not be aware but there are over 34 Canadian REITs trading on the Toronto Stock Exchange TSX. There is also no such Treaty with a reduced withholding tax of 15.

Continue reading but out of the 34 REITs I have selected the top 4. Slate REIT has a dividend yield of 811 which comes out to 112 per share annually. Dividends from REIT companies are generally taxable as ordinary income above the maximum rate of 37 395.

To qualify as a REIT a trust needs to be a publicly traded unit trust that is resident in Canada and must meet tests set out in the Income Tax Act Canada the ITA based on among other factors the nature and quantity of real estate assets owned and the sources of trust revenue. Investment income is taxed at 8. The Canadian government requires that REITs withhold 15 of shareholder distributions defined as return on capital.

It is best to hold. However only 20 have a market capitalization above 1B Covid-19 has done some damage and the distribution not dividends is being adjust by many. Provincial dividend tax credit.

Preferred Canadian Dividend Tax Rate. Things to do Structuring. The reason for this is two-fold.

The marginal tax rate for qualifying dividends is only 257 percent because of the dividend tax credit. This mimics what the payout would have been if companies had not already paid tax on the income. Although some exclusively operate inside Canada many also have international holdings.

Due to the business structure of REITs anywhere from 80 to 95 of the income after expenses are passed directly to shareholders without being taxed at the corporate level. It owns and operates a portfolio of healthcare real estate infrastructure such as. The grossed-up dividend income is 1380.

What is the dividend tax rate in Canada. The REIT takes care of operating expenses owning or financing the income-producing properties for investors. The 293 billion REIT is the lone real estate stock in the cure sector.

Dividends paid out by a foreign-based corporation to a resident in Canada do not qualify for a dividend tax credit and are also taxed at your marginal rate. According to the Canada Revenue Agency current federal tax rates by tax bracket are.

Reits Canada Still Offers Tax Advantages For These Investments

Reit Taxation A Canadian Guide

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

3 Dividend Stocks I D Buy And Never Sell The Motley Fool Canada

13 Best Monthly Dividend Stocks In Canada For Passive Income 2022

The 20 Best Dividend Stocks In Canada For 2022 And What To Look For When Dividend Investing Hardbacon

Taxtips Ca Canadian Dividends No Tax

Dividends A Canadian Dividend Investor S Dream Tawcan

Tfsa Investors This 6 5 Dividend Stock Pays You Every Month

Home Business Tax Expenses Small Home Based Business Tax Deductions Each Home Occupation Permit Henderson Dividend Stocks Dividend Investing Finance Investing

Tfsa 101 You Can Earn An Extra 775 Per Month In Tax Free Retirement Income With This Stock The Motley Fool Dividend Stocks Dividend

Dividends Every Month In 2022 Investing Money Money Strategy Finance Investing

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Reit Taxation A Canadian Guide

Does Investing In American Stocks For Dividends Ever Make Sense If Not Done Via An Rrsp Account R Personalfinancecanada

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube